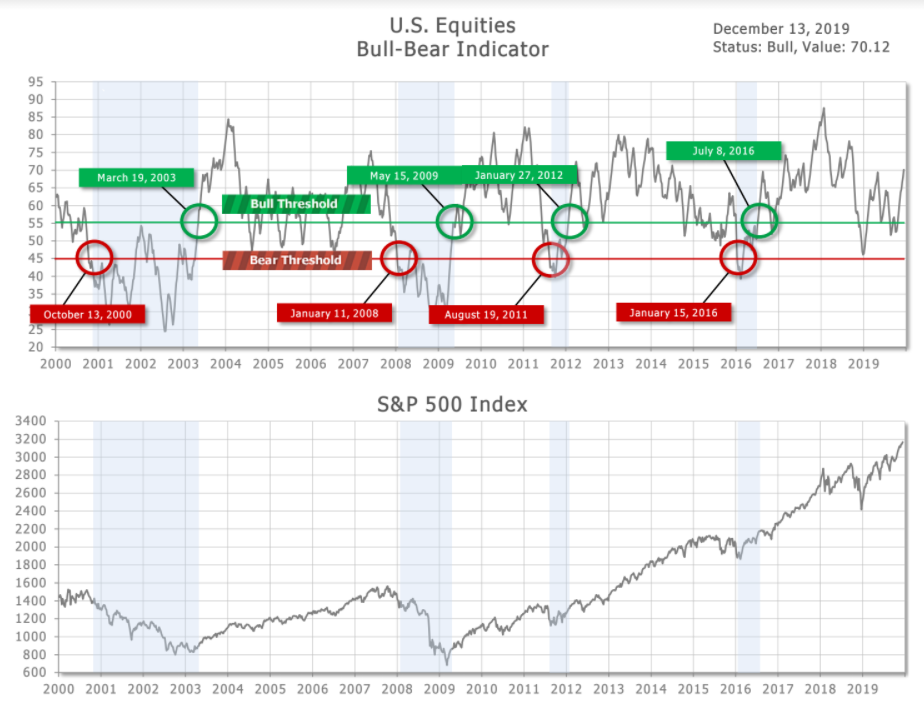

T2R 1.0 Indicator

T2R 2.0 Indicator

This example of risk management indicators uses our AIA sector rotation model.

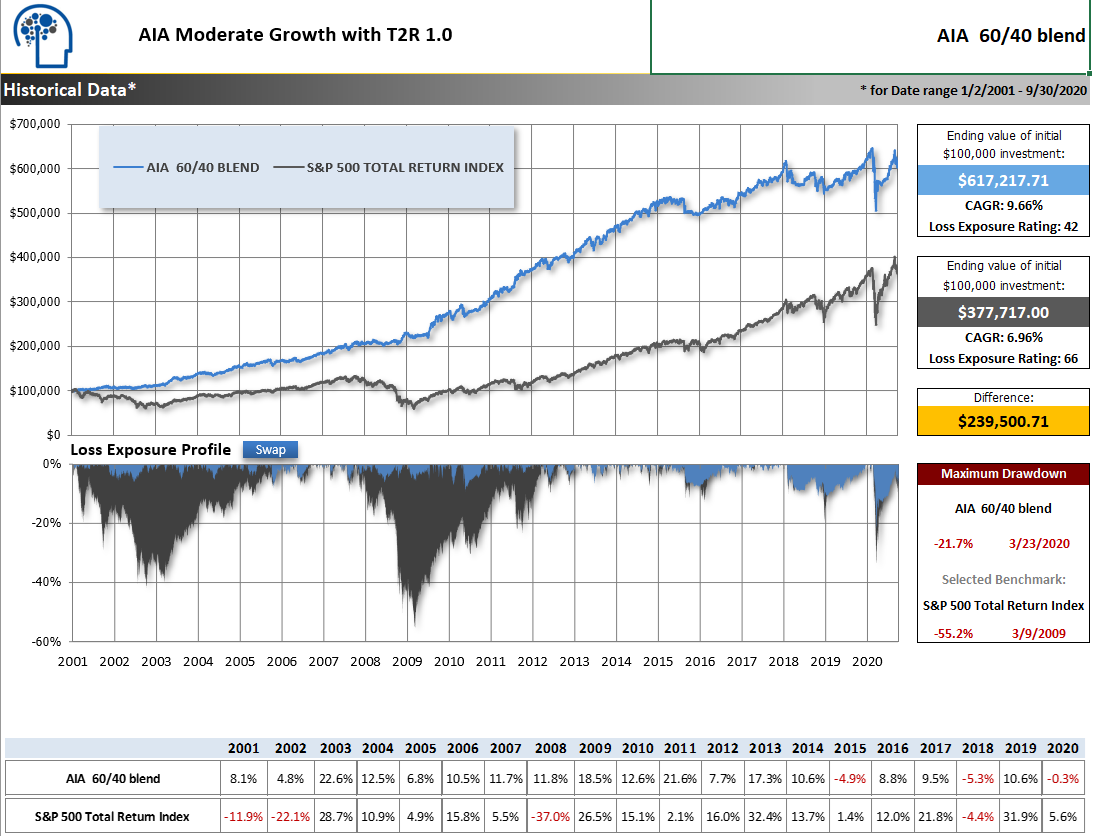

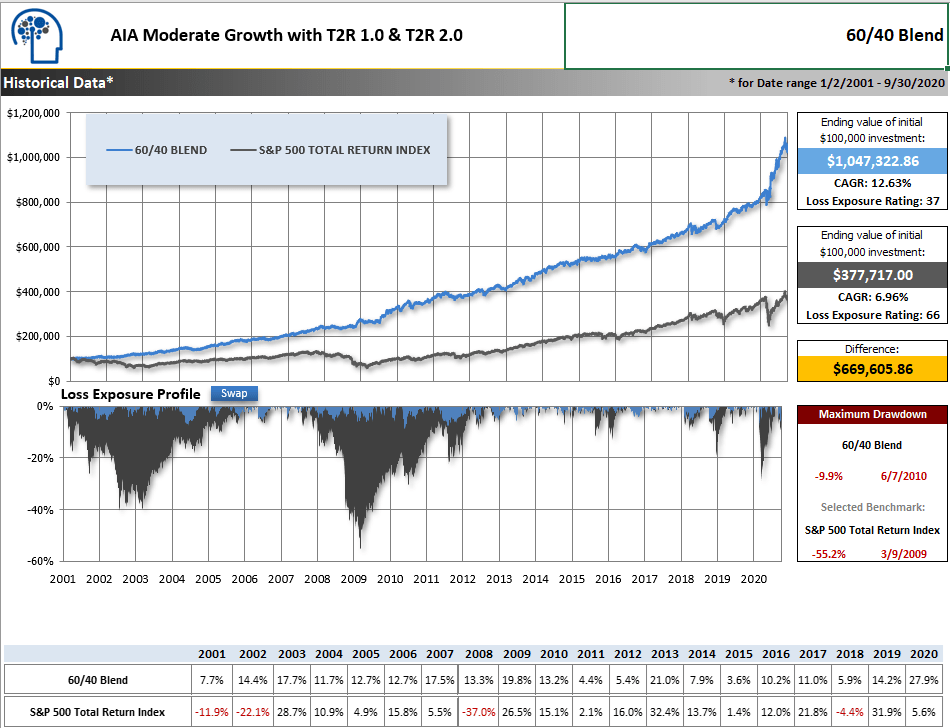

Let's examine two graphs to understand the value of using the T2R 1.0 and T2R 2.0 Risk Management indicators. The top graph compares AIA using only T2R 1.0 with the S&P 500 Total Return Index. The bottom graph shows AIA using both T2R 1.0 and T2R 2.0 together.

Both graphs use a moderate AIA allocation, with 60% AIA and 40% bonds.

In the top graph, using T2R 1.0 alone reduces volatility and increases long-term growth, as shown in the Loss Exposure Profile and Maximum Drawdown.

However, the results improve further when T2R 2.0 is applied alongside T2R 1.0 in the bottom graph. T2R 2.0 helps reduce volatility even more, leading to enhanced long-term growth.

For more details, watch the Adaptive Investment Allocation (AIA) video in our video library or request a demo.

Notes & Disclaimer: The investments used in the adjacent graphs comprise exchange-traded funds representing stock market sectors. Your individual returns will vary depending on the exchange-traded funds and/or mutual funds available to you within your 401(k), IRA, and mutual fund family. The returns shown result from making trades on the same day the newsletter or alert is posted. The returns shown are from January 2, 2001, to September 30, 2020. Stock market indices, like the S&P 500 Index, are unmanaged groups of securities considered to be representative of the stock market in general or subsets of the market, and their performance is not reflective of the performance of any specific investment. Investments cannot be made directly into an index. Historical returns data are calculated using data provided by sources deemed to be reliable, but no representation or warranty, expressed or implied, is made as to their accuracy, completeness or correctness. This information is provided "AS IS" without any warranty of any kind. All historical returns data should be considered hypothetical. Past performance is no guarantee of future results. By using anything on or related to our website, we assume you have done so and acknowledge those terms.