More about DIvidend Income Model

DIM is less concerned about the price movements of its member stocks and much more concerned with the level and consistency of the dividends they provide. Therefore, price fluctuations will generally be tolerated in order to receive dividend payments. A replacement may be suggested if a stock’s price decline becomes too severe.

We at Think 2 Retire suggest that subscribers not attempt to cherry-pick certain stocks within the DIM portfolio. As mentioned above, the stock selections are primarily based upon their dividend-paying ability. Additionally, attention is paid to providing a diversified portfolio of stocks from a variety of industries. Therefore, as a subscriber, you should attempt to hold all the suggested stocks within the DIM portfolio to maintain a diversified approach and fight the urge to concentrate your investment capital in a select few holdings.

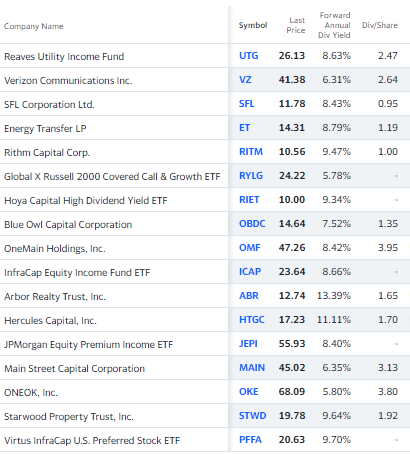

The initial investments in each of the holdings listed in the table above are approximately $10,000.

However, the initial investment may vary depending on the available capital. The model aims to distribute approximately equal amounts among all the holdings.

Please note that maintaining equal investment amounts may be challenging due to price fluctuations of individual holdings.

If you choose to invest more in certain holdings based on their dividend payout or potential for price appreciation, we suggest you strive to maintain a diversified approach within the DIM portfolio.

You can watch the DIM videos available in our Video Library for more information.