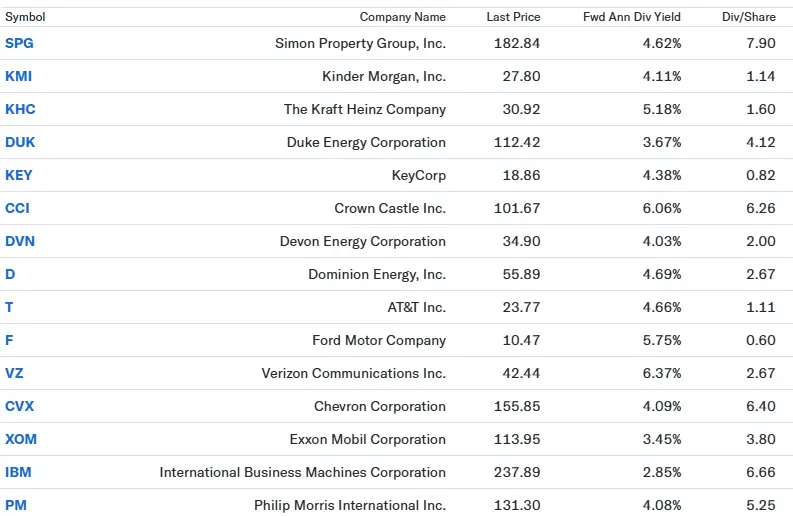

Dividend Growth Model

The Dividend Growth Model aims to provide a portfolio of common stocks paying above-average dividends (4% plus). The stock selection will be weighted towards companies with a history of increasing dividends and price appreciation prospects.

This model is designed for investors who desire current income and a solid long-term return with reduced volatility.

Additionally, the Risk Management Indicators at Think 2 Retire are also applied to this model in an effort to provide additional volatility control and long-term growth. See the website's Risk Management Indicator and Video Library section for more details.

The allocation percentages mentioned in the example portfolio below are not those suggested in the current model allocation. They're for illustrative purposes only.

As always, the subscriber is welcome to deviate from the model's current allocation suggestions to meet their individual needs.

Example Portfolio

Say Goodbye to fee-based advisors

Save yourself time and money while making money in the process. Take the guesswork out of your 401k, IRA, or investment account and take control of your retirement.