The AIA Process: Sector Rotation

At Think 2 Retire, we believe that the main reason individual investors struggle isn't due to a lack of skill or desire but rather the absence of a consistent, rules-based system to guide them through turbulent markets.

Research shows that investors often rely on emotions rather than facts when making investment decisions. Adopting a data-driven and mathematical approach eliminates emotions from the decision-making process, resulting in fewer mistakes and improved long-term performance.

AIA provides this rules-based methodology to individual investors.

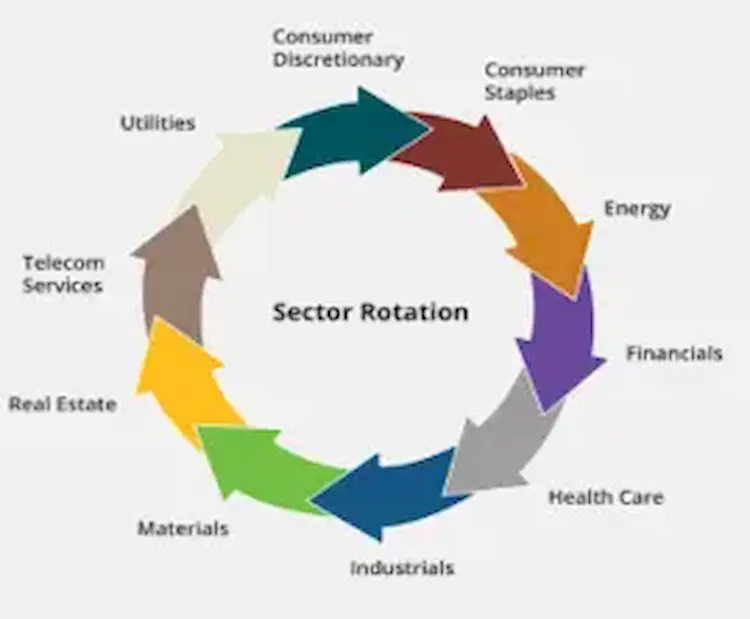

AIA is essentially "Sector Rotation." It aims to keep subscribers allocated to the 4 strongest stock market sectors and avoid the weak, underperforming ones.

We handle all the complex analysis and calculations behind the scenes. Subscribers simply need to understand their personal risk tolerance, open emails from Think 2 Retire, and apply the suggested changes and updates to their accounts.

Individual Risk Assessment

Understanding your appetite for risk is essential as a subscriber. This is important when applying any investment strategy, including the asset allocation suggestions provided by AIA.

Subscribers can utilize AIA within their brokerage portfolios, 401ks, IRAs, or mutual funds according to their preferences. The monthly investment suggestions from AIA may be implemented as a percentage of the overall investment or retirement accounts based on individual risk tolerance.

For instance, if a subscriber considers their risk tolerance moderate, they may opt for a 60/40 allocation. This means that 60% of their portfolio may be allocated to the AIA suggestions, while the remaining 40% may be allocated to more secure investment options like bonds, money markets, or fixed accounts.

In essence, subscribers have the freedom to choose any percentage they find suitable for utilizing AIA in their investment strategy.

In the AIA video, we showcase two visual examples demonstrating the use of AIA at different risk levels. These examples are designed to describe the growth potential and risk management based on varying levels of AIA use. The examples are "Moderate Growth" and "Aggressive Growth."

In each example, a certain percentage of the total portfolio is invested in areas suggested by AIA. As risk tolerance increases, the allocation to AIA also increases.

It's important to note that AIA does not always advocate for staying fully invested. Therefore, each example has a maximum percentage allocated to AIA to ensure prudent risk management.

During periods of market strength, the AIA portion of a portfolio will remain fully invested. However, when the AIA Risk Management Indicators signal a likely market weakness, Think 2 Retire will issue an Alert advising subscribers to reallocate to bonds or cash. This helps protect account value and reduce risk. You can learn more about this process by watching the AIA video.

Here are three different approaches that subscribers may adopt with AIA, depending on their risk tolerance. Subscribers are free to use AIA as they choose. These risk-oriented approaches are meant as suggestions. Your individual risk tolerance is a personal decision and be considered carefully.

Conservative Growth: 30% maximum AIA exposure. During periods of positive market strength as described below in Step 2, this example holds a maximum equity (AIA) exposure of 30%. The remaining 70% of the portfolio will be in either Bond or Money Market or Fixed Accounts.

Moderate growth: 60% maximum AIA exposure. During periods of positive market strength as described in Step 2, this example holds a maximum equity (AIA) exposure of 60%. The remaining 40% of the portfolio will be in either Bond or Money Market or Fixed Accounts.

Aggressive growth: 90% maximum AIA exposure. During periods of positive market strength as described in Step 2, this example holds a maximum equity (AIA) exposure of 90%. The remaining 10% of the portfolio will be in either Bond, Money Market, or Fixed accounts.

When the AIA risk management tools detect market weakness, Think 2 Retire will send an Alert advising subscribers to switch their equity or stock positions to bond or cash investments. This helps avoid volatility and minimize losses during periods of market distress. As a result, the examples mentioned earlier are completely out of the stock market during such times.

It's important to note that these examples are provided to give subscribers an idea of how to use AIA based on their own risk tolerance. Subscribers can choose to incorporate AIA within their portfolio at any percentage level they deem appropriate.

Assessment of Current Market & Economic Conditions

The best offense is a good defense: The stock market is always changing, and Think 2 Retire uses its AIA system to monitor and analyze market data constantly. When the AIA risk management tools indicate continued market growth is likely, subscribers receive recommendations for maximum equity exposure in industries, sectors, and asset classes displaying strong performance. The monthly newsletter will display the exact mutual funds or exchange-traded funds to use in your allocations.

On the other hand, when the risk management tools suggest a continued weak or a negative market phase, AIA will recommend a minimum equity exposure of 0%. During these times, subscribers receive Alerts with bonds or cash fixed account options to reduce volatility and risk.

Think 2 Retire aims to recognize market trends early and provide allocation suggestions accordingly, helping subscribers capture the lion shares of market gains and avoid significant losses. AIA analyzes market data and indicators such as market breadth, sentiment, and moving averages to determine the market's probable direction and identify attractive sectors and asset classes.

By applying the research and recommendations provided by Think 2 Retire, subscribers can make informed decisions and optimize their equity allocations based on market strength or weakness. The heavy lifting of analyzing the data is done by Think 2 Retire. Subscribers receive the outcome of this analyze in their monthly newsletter. Afterward, this can be implemented in their investment accounts, 40k1s, IRAs, and brokerage accounts.

Asset Class and Sector Ranking

The stock market consists of various asset classes and sectors that behave differently based on economic and market conditions. AIA continually evaluates and ranks all asset classes and sectors, prioritizing them based on recent price performance and relative strength.

These rankings are used to create the current asset allocation suggestions provided in the Think 2 Retire monthly newsletter and Email Alerts. The suggestions typically include:

- 4 Exchange Traded Funds (ETFs) for use in brokerage accounts

- 2 to 6 mutual funds for use in 401k and Mutual Fund accounts

The goal is to provide subscribers with updated investment allocations focusing on areas poised for near-term growth while avoiding the underperforming areas.

Subscribers receive these allocation suggestions in the monthly newsletter, delivered on the first business day of each month, or through email Alerts as needed.

New subscribers will gain access to the current newsletter and suggested allocations upon registration and completion of an onboarding demo.

Think 2 Retire will not provide individual investment or financial advice. All subscribers receive the same allocations and ALERTS at the same time. The onboarding demo is designed to teach and educate new subscribers on the most efficient way to use the Think2Retire newsletter for their benefit.

Constant Monitoring

Think 2 Retire continually performs steps 2 and 3 behind the scenes. It's recommended to review your Individual Risk Assessment annually, as discussed in Step 1.

Every month, subscribers will receive asset allocation suggestions based on a thorough analysis of market metrics and data points from steps 2 and 3. These suggestions are emailed on the first business day of each month or through email Alerts.

Think 2 Retire handles the heavy lifting, making it easy for subscribers. Simply view the Think 2 Retire newsletter or Alert when received, and apply the updates. Log into your 401k, IRA, Mutual, or brokerage account and make the necessary changes.

Sector Rotation Returns

2023 38.9%

2024 20.5%

60 Day Free Trial Subscription

Take Think 2 Retire on a free test drive.

You will see the value of having an Adaptive Investment Allocation (AIA) methodology.

After 60 days if you are not convinced of Think 2 Retire ’s value, you may simply “unsubscribe”. No hard feelings. During your trial subscription you’ll be treated as an active subscriber.

After completing a live Demo you’ll be entitled to:

- Current and past Think 2 Retire newsletter issues

- Current asset allocation suggestions

- Market updates and commentary

- Video library designed to help you understand and implement Think 2 Retire and AIA

- Ongoing live webinars

- All archived webinars